Examine This Report on Chapter 7 Bankruptcy

Get Charge of your fiscal perfectly-currently being Along with the leading financial debt consolidation Loans. Implement on the web now and start developing a decide to pay back your financial debt.

A trustee will be appointed from the courts to research your stories and ensure creditors receive any lots of payments as possible.

Nonetheless, the lender filed a movement requesting which the bankruptcy court docket lift the automated stay. Because the lender's lien gave the lender the appropriate to Get well the home, the decide granted the motion, and Lynn missing your home.

That's for the reason that most home bank loan applications Have got a waiting period, that may be anywhere from 1 to 4 years from the date of the discharge. The period of time is typically more time if you filed for Chapter seven bankruptcy.

Considering that Chapter eleven indicates you could repay your debts, some vendors let you submit an application for unique life insurance policies prior to the bankruptcy is discharged. You’ll generally ought to present your service provider secure financials as well as the accredited repayment system.

The courtroom assigns a trustee towards your case who will deal with the liquidation of the belongings and pay your creditors Together with the proceeds. Selected belongings are exempt, but the kinds and amounts can vary by state.

Does bankruptcy ruin your life? It surely doesn’t must. Actually, it’s good news to are aware that bankruptcy is more details on acquiring a 2nd prospect with all your finances than Bonuses struggling from penalties.

Develop into a licensed consumer. Should you have a beloved just one who employs their bank card responsibly, take into account inquiring them to include you as a certified consumer within the account. After you have authorized-user position, the account's comprehensive heritage will present up with your credit experiences, that may enable increase your credit score rating.

Once you apply, you’ll should show stable financials, together with evidence of constant employment and cash flow, and information regarding your debt and credit why not try here score report.

Generally, filers can continue to keep some equity for most sorts of vital property, which include the next:

That relies on the kind of bankruptcy you qualify for. Using a Chapter 7 bankruptcy, your belongings will Resources be marketed (except Potentially your private home and car or truck), along with your creditors will be paid off While using the proceeds.

With this data, you'll need go to my blog a better manage on how your steps effects article source your credit and which measures you usually takes. You'll also be capable of monitor your progress all over the rebuilding system.

Comply with up with Individuals references, and look for referrals from trusted family members. You can glance to your local State Bar Affiliation for a summary of practicing bankruptcy lawyers close to you.

Bankruptcy can provide financial aid in the shape of a restructured debt repayment approach or simply a liquidation of specified assets to pay off a percentage of your credit card debt.

Mr. T Then & Now!

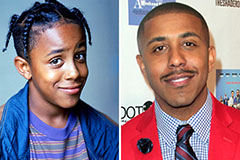

Mr. T Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Mason Reese Then & Now!

Mason Reese Then & Now! Bernadette Peters Then & Now!

Bernadette Peters Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!